Table of Contents

The Nostalgic Kind

Classical Gas is the name of an oldie from the mists of time when Tommy Smothers still strode the airways and one of his writers, Mason Williams wrote and produced a catchy arrangement for virtuoso guitar. (It featured the combined efforts of Williams, Eric Clapton and the Wrecking Crew which, was the LA branch of the Intergalactic All-Star Studio Band Trio that included Detroit's Funk Brothers and the improbably located Muscle Shoals.)

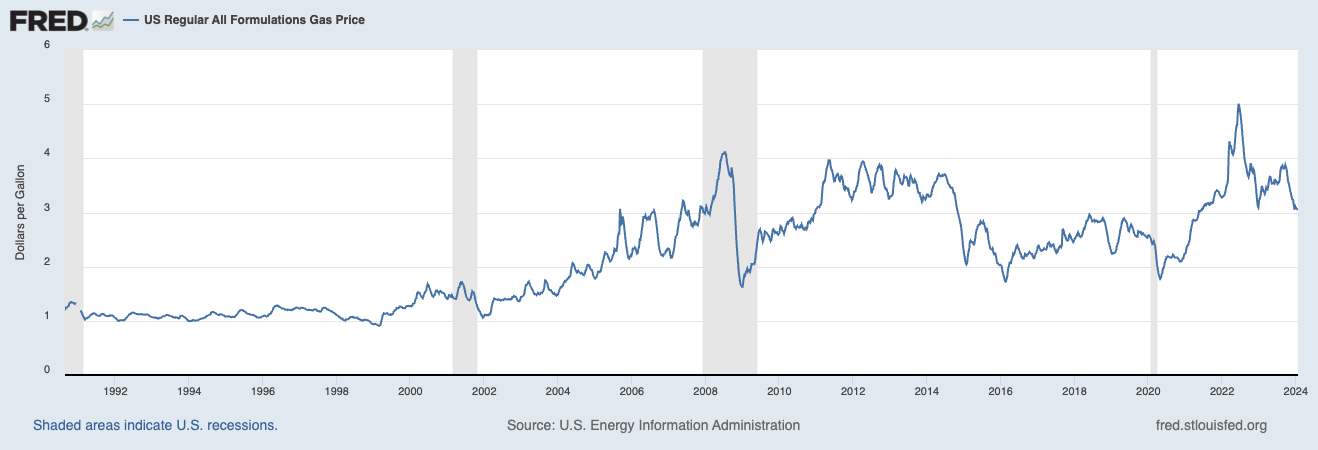

Price at the Pump Gas

The gas I'm talkin' about, though, is the other kind. It illustrates a shortcoming of classical economics, which is that some economic goods represent values poorly described by economics due to memory. During some point in their driving career many drivers form an opinion of what gas should cost and when the implacable trio of supply, demand and greed conspire to push prices above that baseline, the higher facilities begin to dissolve. It's in mind now because its the presidential election year.

Every election includes the economy, stupid. The incumbent is assailed for failing to keep the lid on and, often, the challenger is prescribing more investment in public transit if a Green, or drill, baby drill from the Reds or, often it's temporary and it's not all that unusual, adjusted for … . Each of those specific positions face difficulties

- people are reluctant to give up their beloved cars and trucks to share personal bubbles with strangers and residential densities most places that people live make high-speed rail transit, for example, infeasible because it's necessarily a matter of a mini-commute to the nearest station—automobiles in motion tend to remain in motion

- supply-side solutions overlook that fracking has made the US a net exporter of petroleum, but you'd think maybe it make us less susceptible to being held hostage by OPEC; there's also the problem that world petroleum prices are set at the margin, not the average and selling into the world market at higher volumes will tend to depress prices which will tend to boost demand

- getting out the green eyeshade and adding machine or doing it on your devices and doing the math results in confusion concerning how we integrate volatile market conditions with everything else affecting ourlives into a coherent world view.

Simpler = Easier

During our daily lives if we had to stop and analyze everything from scratch to decide if a gallon of gas was worth, say, \$5, people on my block would have to decide whether they might be better off walking the 3/4 mile to the grocery, considering the weather, the shopping list, how low they think the tank is and what the price is likey to be. They probably won't sell the vehicle to avoid having to ever think about it. Instead they drive to the pump and fill the tank because of what economists call high price elasticity. The value placed on mobility with convenience and privacy is consistently high, regardless of monetary costs. When prices fade, the memory doesn't. I can recall only one time when people were amazed at how low prices had fallen, back in the mid-80s.

The Bloom County comic's penguin Opie was shown at the pump giddily spraying himself with 86¢ gas. In Alaska, it was more doom and gloom, like this plaintiff prayer

And, of course, many people don't worry about mileage

(At a wedding a few years ago, a relation was wondering aloud why anyone would want to drive around in a sedan and have people looking down on them.)

Value, price, rationality

The seeming disconnect of people valuing gas and continuing to purchase as prices continue to rise in defiance of even a simple cost analysis shouldn't be surprising. My father was, charitably, a tightwad. He insisted he was simply thrifty, having grown up in the Great Depression. It didn't seem to strike him as inconsistent with his family getting through fairly comfortably, continuing to trade in cars every other year. Nor was there a disconnect in citing his job as a salesman as the reason he was always so well dressed. But he may have been on to the core of an idea.

The years that you get used to buying your own gas mold your sense of what it should cost

Drivers who started in the 90s may think that around \$1/gal. is about right. In the oughts maybe \$2/gal.? and the shock of the Great Recession spike and drop didn't change much. I the teens perhaps it was \$2.50/gal. The latest spike and plunge ended at \$3/gal. So, by any of the perspectives of the pass three decades it's just too damned much. And the rise of other prices doesn't signify.

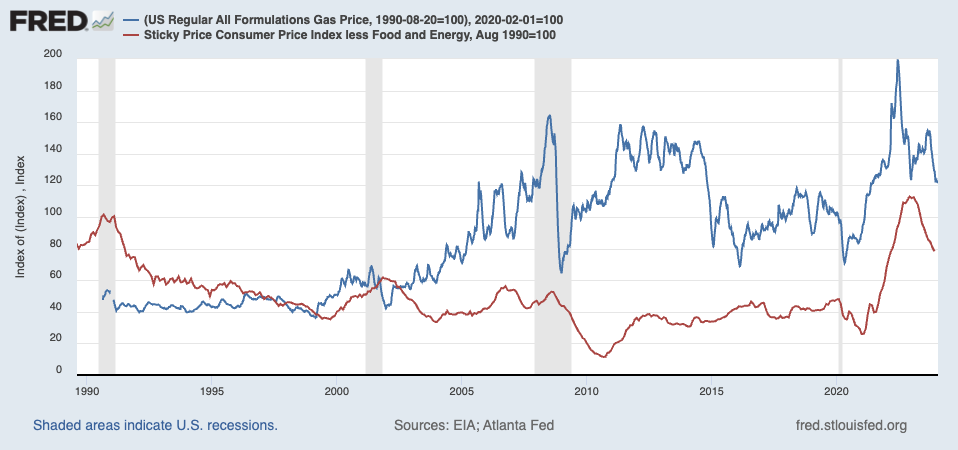

And it does nothing to move the needle to point out how gas prices have moved relative to other prices over the same period.

For most of the past 30 years gas prices based on the index, not nominal dollars, have increased faster than consumer prices less gas and food. With the COVID-19 epidemic they moved up in sympathy and then back down. Gas prices, approximately, are what prevailed last in 2015. For the index of other prices, we are partying like it was 1980. Maybe it's down to that gas prices have an implicit baseline but the basket of goods don't. I might remember that top-shelf egg brand reached \$18/doz. within the last year and that stands in for groceries even after I notice the house brand at \$2/doz because I don't have prices changes in the entire shopping cart in my head.

And then there's the political. Under my guy every thing was perfect. Yeah? Under my guy everything is perfect.

Human nature

It doesn't always compute, does it?

Mascot of the Day