Table of Contents

Continuing an exchange of comments

Regarding the current state of capitalism – from a comment thread in the beneath the pavement substack with David Jones.

After a summary of the positions taken, I raise questions that revisit a pending question: Why do we have an economy?

Income inequality has surged

- Wage growth suppressed

- Household purchasing power plunging

Vicious cycle of low consumption

- Less money to spend

- Consumer demand nosedives

- Revenues & profits crash for companies

Companies cut labor costs to protect profits

- Slash wages

- Eliminate benefits

- Offshoring

Cost cutting backfires ultimately

- Employee income sinks further

- Consumer spending plunges deeper

Offshoring accelerates race to bottom

- Jobs relocated to low-cost countries

- Cheaper goods but income sinks at former countries

- Potential to reprise the experience

- Induced demographic changes also contribute

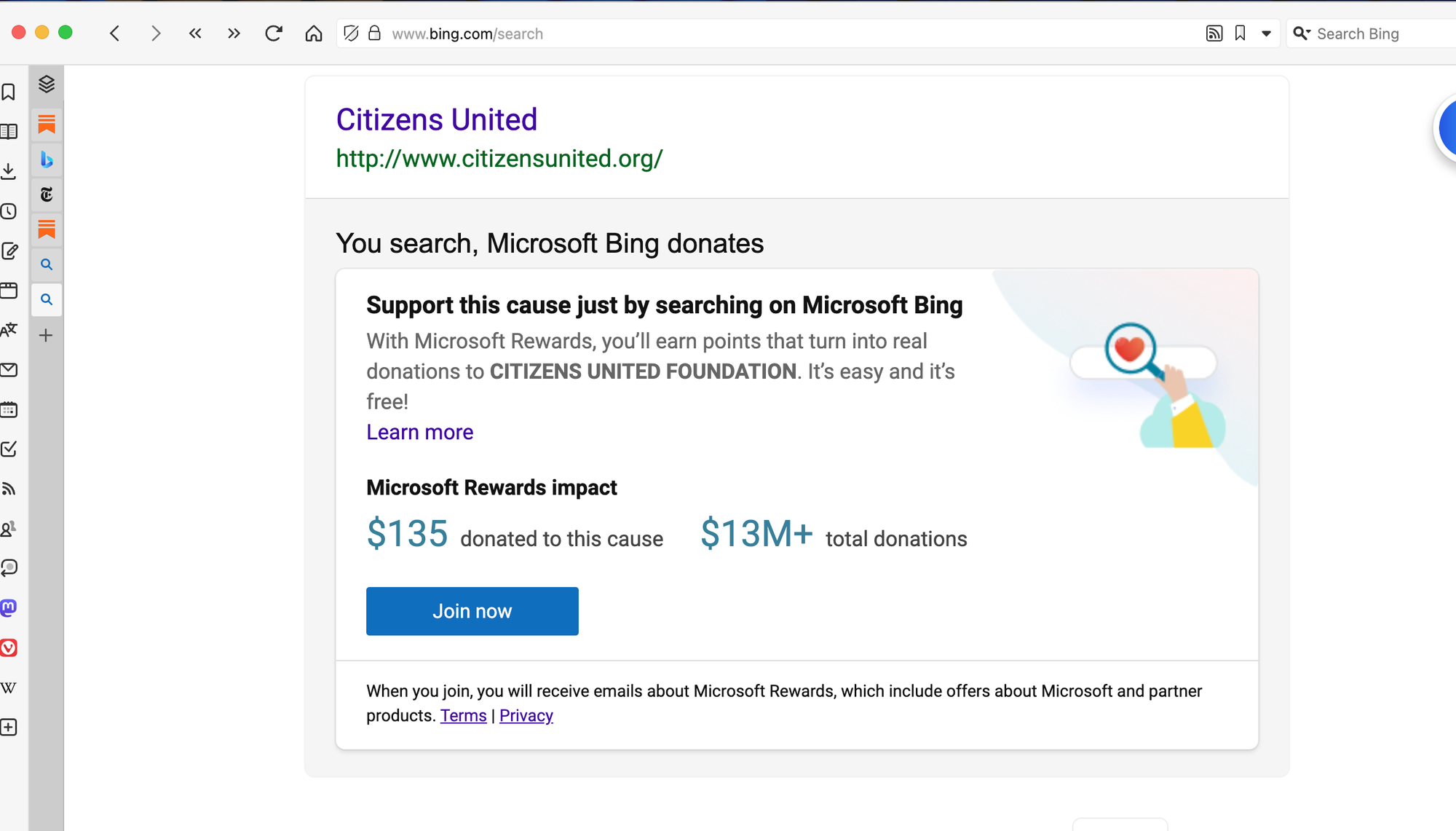

Shortsighted financial asset engineering

- Incentives to hoard wealth, not invest

- Speculative bubbles over real economy

- Capital accumulates in financial assets—frozen liquidity

Widening inequality strains society

- Budgets gutted with lower tax revenue

- Debt and inequality handicap growth

- Political influences of mega-rich distort rules of exchange

Is inequality a cause or an effect

- What role for the service economy?

- Is the economy shifting to intangibles?

- Does material well being still have the same prominence?

What is the exact nature of the problem?

- Is the mis-allocation of capital a problem of asset retention?

- Is it a drag on innovation?

- Does its concentration leave insufficient liquidity available for current consumption?

- Does the debate mischaracterize the issue as static when it should be dynamic?

- Is a treasure chest framing better than a flow of funds and liquidity analysis

Against Scarcity

- Advances in US personal economic security through 1960[1] an anomoly?

- Is the under-appreciation of the reduction of severe poverty worldwide[2] salient?

- Is there a distinction between need and want?

- What are the limits on economic activity based on transactions in tangible property?

Further questions

- Does this line of argument recapitulate views of the 19th century?

- If so, what are the criticisms of those views?

- Does the line extend or contract Piketty[3]?

- Have changes in conditions weakened or strengthened the construct?

- Is the concentration of power over the political environment of more urgent concern than power over the market environment